The shift to as-a-Service or XaaS is reshaping the tech industry, with businesses looking to move from traditional CAPEX technology purchases to more flexible, OPEX-based solutions.

According to a report from GlobalNewsWire, the Network as a Service market is expected to grow by 35% to 285.9 billion by 2032—and that's just one type of solution.

Quoting as-a-Service solutions is far more complex than traditional models, especially when the average customer solution includes six different products and services.

The truth of the matter is building a quote and proposal involves layers of complexity that most existing CPQ software can’t support.

- How do quote multiple products and services that all have different pricing models?

- How do you manage pricing and margins?

- How do you measure profitability?

- How do you provide the right agreements?

- How do you avoid cashflow constraints?

- How do you fund each deal?

- How do you avoid liability and risk?

Traditional CPQ software simply isn’t designed to handle this level of complexity.

Key Risks of Not Offering XaaS?

If your MSP isn’t offering XaaS solutions, you risk losing out in several ways:

- Missed revenue from not capturing recurring payments.

- Lost customers to competitors who offer contracts with monthly payment options.

- Reduced long-term customer relationships by only offering upfront payments.

- Limited growth opportunities by not converting one-time projects into subscriptions.

- Increased financial strain by not leveraging banks to handle credit and financing.

Before we were TechGrid, we were an MSP that built a successful Network as a Service business with 85% of our customers choosing as-a-Service when offered.

Everything we learned about moving our business to a subscription-model we've used to build the Technology Finance app that's available inside of the TechGrid platform to make it easy for you to grow your own XaaS business without the risk or complexity.

Introducing the Technology Finance App with TechGrid

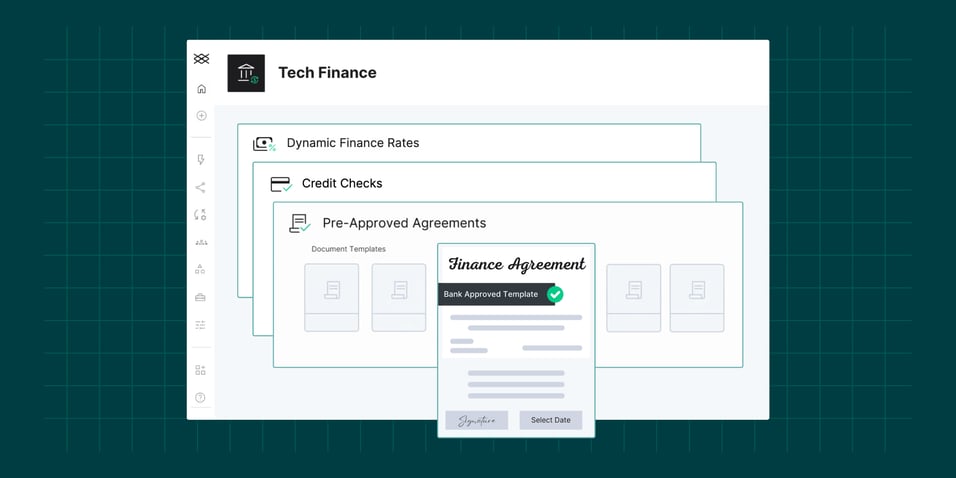

Technology Finance is an app that can be activated within the TechGrid platform that seamlessly integrates financing from major banks directly into your sales workflow. With this app, you can quickly create as-a-Service quotes and proposals. Activating the app is simple — just connect with our financing partner and once set up, it becomes fully embedded into your quoting process.

The app is designed to convert any combination of product and services into as-a-Service solutions, meaning you're not limited to what you can offer your customers.

How Technology Finance benefits your customers:

- Increased buying power: With lower or no upfront costs, customers can purchase everything they need without having to make compromises or delay refreshes.

- Better end-user experiences: Buying everything you need at the same time enables your customers to keep up with their end-users demands.

- Consistent refresh schedule: This makes budgeting and planning easier and more predictable.

- Scalability: Financing makes adding new locations or updating existing ones faster and again more predictable.

- More efficient operations: Standardizing manufacturers and configurations and operating with defined SLAs reduces the administrative and support burden for everyone.

How Technology Finance Benefits MSPs

Simplified Budgeting and Planning: Makes financial planning easier and more predictable, so you can focus on long-term growth.

Faster Sales with Embedded Financing: Enables your sales team to close deals faster by offering seamless financing options directly within quotes.

Accurate Pricing with Dynamic Finance Rates: Ensures you’re always offering the most competitive finance rates, eliminating pricing errors and boosting customer trust.

Increased Revenue with Subscription Models: Converts one-time transactions into reliable recurring revenue, leading to more consistent cash flow.

Reduced Financial Risk: Protects your business from financial exposure by letting the bank handle the liability, freeing up resources for growth.

Greater Flexibility: Provides customers with more convenient payment options, leading to higher satisfaction and loyalty.

Higher Company Valuation through Recurring Revenue: Grows your company’s valuation by increasing predictable, recurring income streams.

Effortless Finance Management: Removes the need for complex finance negotiations, allowing your team to focus on driving revenue instead of managing finance terms.

The Technology Finance app inside TechGrid, empowers MSPs to offer more flexible and modern solutions, grow revenue, and increase your business valuation, all while removing financial risk and quoting complexity.

Book a demo to see Tech Finance for yourself.